Obtain the Best Prices on Jumbo Loans with Your Mortgage Broker Glendale CA

Obtain the Best Prices on Jumbo Loans with Your Mortgage Broker Glendale CA

Blog Article

Understand How a Mortgage Broker Can Navigate the Complexities of a Jumbo Funding for You

Comprehending the details of acquiring a big lending can be challenging, yet an experienced mortgage broker can be your directing light via this complicated process. By diligently evaluating your economic landscape, these specialists attach you with the most suitable lending institutions, simplifying the difficult application actions and handling important paperwork. Their capacity to personalize and bargain positive prices lending terms is indispensable, leveraging longstanding relationships with lenders to secure exclusive offers. What makes a mortgage broker really crucial in browsing jumbo fundings? Discover how their expertise could be the secret to unlocking your excellent monetary option.

Specifying Jumbo Finances

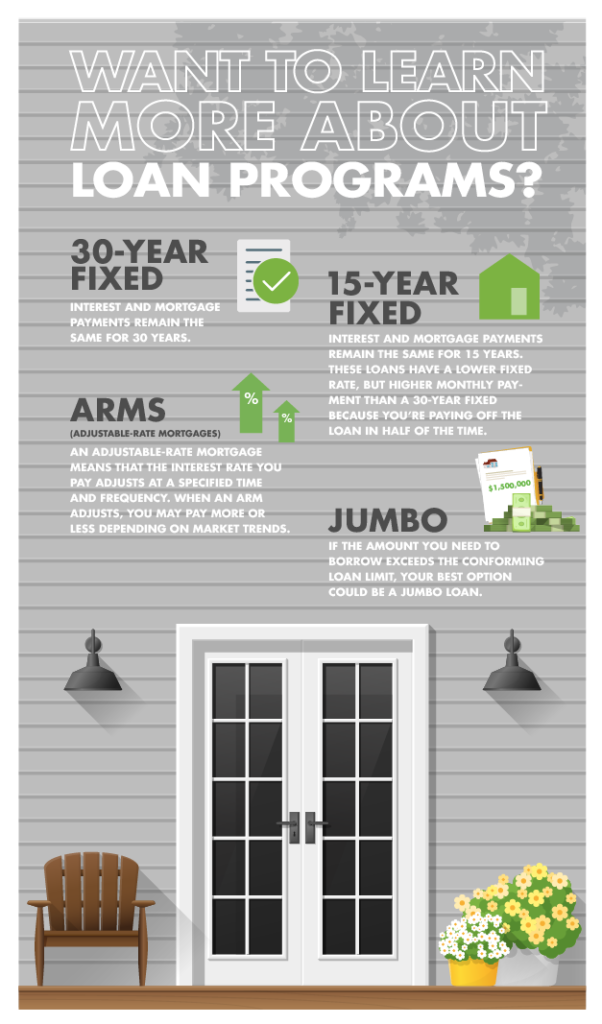

Jumbo fundings, additionally referred to as non-conforming fundings, are a sort of home loan designed for high-value homes that surpass the limitations established by the Federal Real Estate Financing Agency (FHFA) for standard adapting car loans. These restrictions are adjusted each year and differ by place, reflecting the varying residential or commercial property values across various regions. For 2023, the standard adjusting lending limit for a one-unit property is $726,200, with higher limitations in specific high-cost areas. Characteristic going beyond these limits need a big lending.

Jumbo fundings provide to consumers seeking funding for high-end homes or residential or commercial properties in competitive actual estate markets. Generally, lending institutions call for a higher credit history score, substantial cash money reserves, and a larger down repayment compared to conforming financings.

The rate of interest prices for jumbo car loans can be greater as a result of the increased danger, although they can in some cases be competitive with conforming lending rates depending on market conditions. Comprehending the subtleties of jumbo lendings is vital for debtors seeking to secure funding for high-value residential properties.

Function of a Mortgage Broker

A skilled home loan broker plays a critical role in browsing the complexities of securing a big car loan. They thoroughly examine the consumer's creditworthiness, economic background, and specific financing needs to match them with the best feasible loan provider.

In the realm of jumbo lendings, where stricter underwriting criteria and greater down payment needs often prevail, mortgage brokers give essential guidance. They have comprehensive expertise of the lending landscape, aiding debtors understand prices, terms, and problems, which can vary significantly amongst lending institutions - jumbo loan. Their ability to work out desirable terms is critical in protecting competitive passion prices and lending problems that line up with the borrower's lasting economic objectives

Additionally, home mortgage brokers simplify communication in between all parties entailed, making certain openness throughout the loan process. Their role encompasses encouraging customers on paperwork, giving understandings into market fads, and facilitating a smoother deal. Ultimately, a skillful home mortgage broker acts as a trusted advisor, simplifying the trip to obtaining a jumbo car loan.

Simplifying the Application Process

Browsing the intricacies of a big car loan application can be daunting without expert assistance. A home mortgage broker plays a pivotal function in streamlining this detailed procedure, guaranteeing that borrowers can successfully handle the demands of securing a jumbo financing. These fundings commonly go beyond the limitations established by traditional funding, demanding a detailed understanding of distinct needs and underwriting criteria.

Furthermore, mortgage brokers have substantial expertise of the particular standards different lending institutions make use of to assess jumbo finance applications. This experience allows them to match debtors with lenders whose requirements line up with their monetary accounts, improving the likelihood of approval. Brokers likewise give beneficial insights right into the nuances of the application process, clearing up each action and offering assistance on dealing with any kind of challenges or inquiries that might develop.

Discussing Affordable Rates

Securing affordable prices on jumbo fundings needs tactical negotiation abilities and a deep understanding of the borrowing market. Home loan brokers play a pivotal role in this procedure by leveraging their expertise and relationships with lenders to make certain customers get one of the most desirable terms. Given the substantial dimension of big finances, also minor decreases in rate of interest can bring about substantial savings over the life of the funding.

Mortgage brokers use their in-depth knowledge of market patterns, passion rate variations, and lending institution requirements to offer an engaging instance for competitive rates. They conduct comprehensive analyses of the consumer's financial account, highlighting staminas such as high earnings, considerable assets, and exceptional credit report, which can be significant in protecting much better read more prices. Brokers usually have access to exclusive offers and price discounts not easily offered to private customers.

Brokers expertly browse economic indications and lender plans, encouraging customers on the optimum time to secure in rates. This critical approach eventually helps with even more budget-friendly and convenient big car loan plans.

Tailoring Fundings to Your Requirements

When customizing big financings to fit private requirements, home loan brokers have to take into consideration the unique monetary objectives and circumstances of each borrower. This entails a comprehensive assessment of the consumer's monetary account, consisting of revenue, credit history, and long-term goals. By recognizing these aspects, brokers can recognize financing frameworks that straighten with the debtor's capacity and aspirations, ensuring that the home loan is both helpful and convenient over time.

A vital part of customizing car loans is picking the appropriate interest rate type-- taken care of or adjustable. Taken care of prices use security, suitable for those planning to stay long-term, while adjustable rates might fit customers anticipating changes in their economic situation or those that intend to offer before the rate readjusts. Furthermore, brokers can adjust finance terms, stabilizing elements such as regular monthly payments and general finance prices to match the customer's choices.

Additionally, brokers can provide advice on deposit methods, potentially minimizing funding amounts and preventing private mortgage insurance policy. By checking out various loan provider programs, brokers can uncover niche items or motivations that might benefit the debtor. Fundamentally, a home loan broker's proficiency allows a custom loan solution, tailored specifically to fit the consumer's way of living and economic trajectory.

Verdict

In final thought, mortgage brokers play a critical duty in assisting in jumbo loans by expertly navigating the intricacies involved. Brokers tailor lending terms to straighten with customers' details economic demands, eventually enhancing results.

Jumbo finances, likewise recognized as non-conforming financings, are a type of home mortgage developed for high-value residential or commercial properties that go beyond the restrictions set by the Federal Housing Finance Agency (FHFA) for conventional adapting fundings. A mortgage broker plays a crucial duty in streamlining this complex procedure, ensuring that customers can effectively manage the demands of safeguarding a big finance. Given the considerable size of jumbo see post lendings, also small reductions in interest more info here prices can lead to considerable savings over the life of the funding.

When tailoring jumbo fundings to fit specific needs, mortgage brokers should think about the unique financial goals and scenarios of each borrower. Furthermore, brokers can change lending terms, stabilizing variables such as regular monthly repayments and general financing expenses to match the borrower's choices.

Report this page